The Best DeFi Solution in 2024! Meteora on Solana

Are you ready to plunge into the thrilling world of DeFi on the Solana blockchain? Meet Meteora: the top spot to crank up your yield game.

Hear me out before you brush this off as just another DeFi platform. The same stellar team behind Jupiter is the brains behind Meteora. They’ve got so much on their plate that they split in two to manage the explosive growth of both projects. Now that’s some serious dedication to the DeFi space, folks!

If you are more of a visual person, I have a full video, with lots of timestamps, to hold your hand through this DApp.

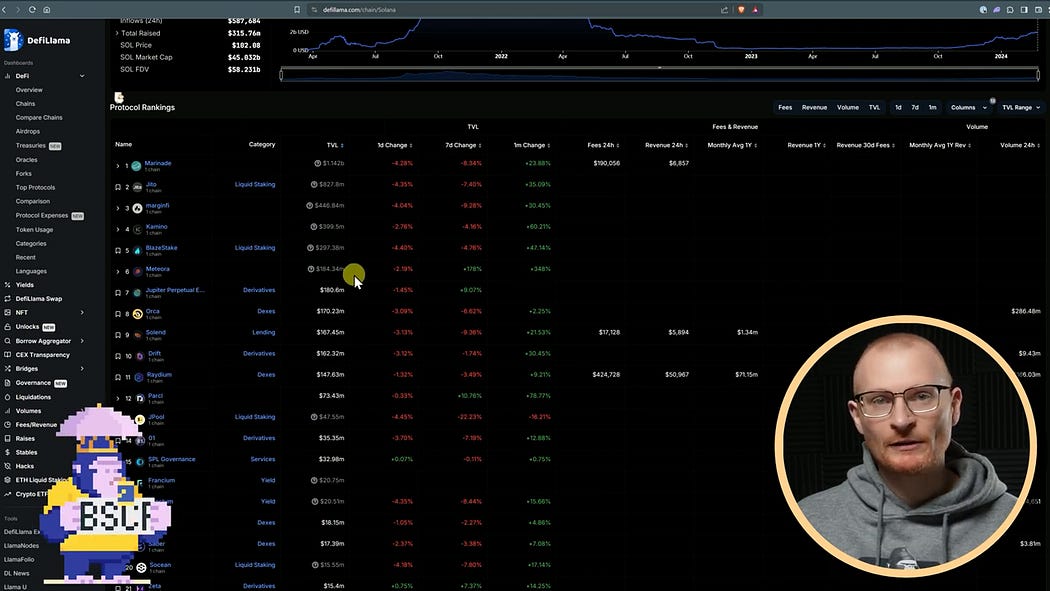

But don’t just take my word for it. Let’s take a look at some cold, hard numbers over at DefiLlama. On Solana’s section, big players like Marinade and Jito are killing it with their Liquid Staking Tokens, mSOL and JitoSOL. Yet, coming in hot at number 6 is Meteora, boasting $184 million in Total Value Locked (TVL).

In the world of DApps performing liquidity pool acrobatics, Meteora not only competes but takes the cake for liquidity when stacked against the likes of Orca and Raydium.

Back in 2021, Meteora was swimming in over $200 million in liquidity; that was the middle of a bull cycle. Fast forward to mid-2023, it dipped to about $9.5 million before soaring like a phoenix from the ashes. Now, that’s some impressive growth trajectory!

The Various Products on Meteora

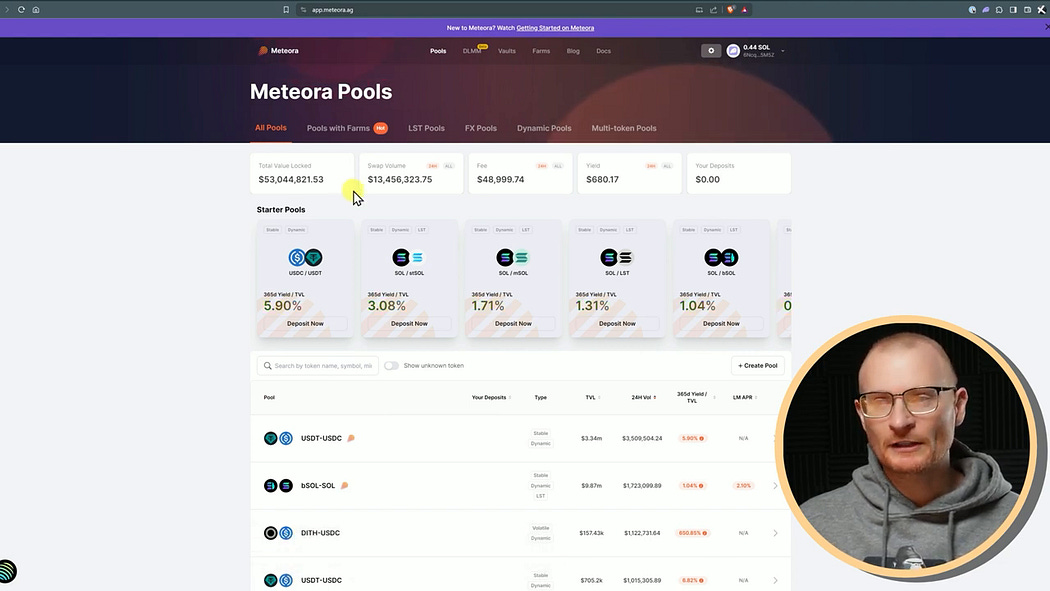

1. Liquidity Pools: These are pools of tokens that are locked in a smart contract to provide liquidity, similar to the pools on Orca and Raydium.

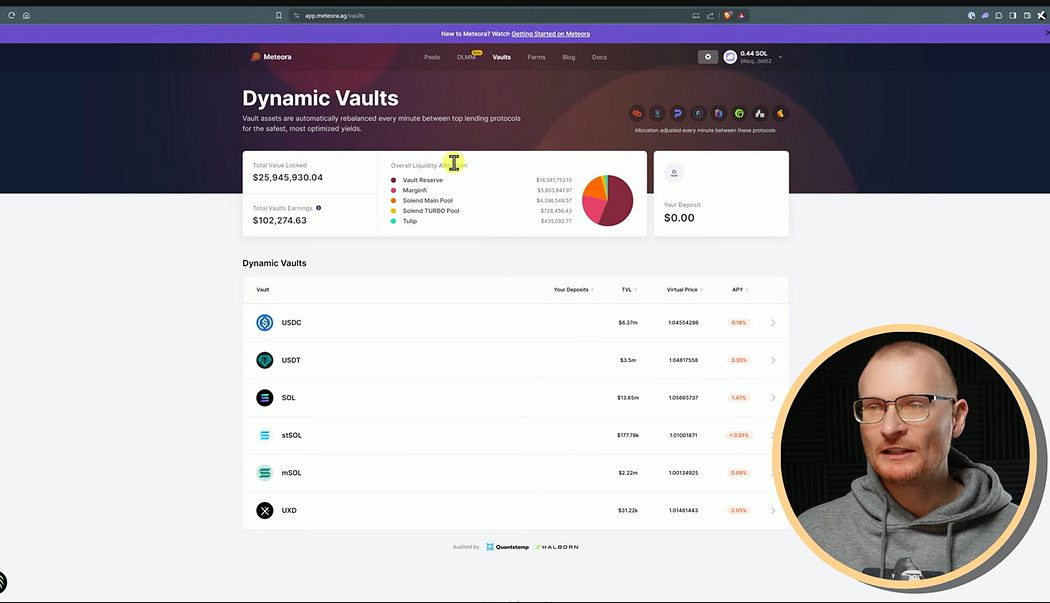

2. Dynamic Vaults: These sling your capital into various DApps to fetch you a return.

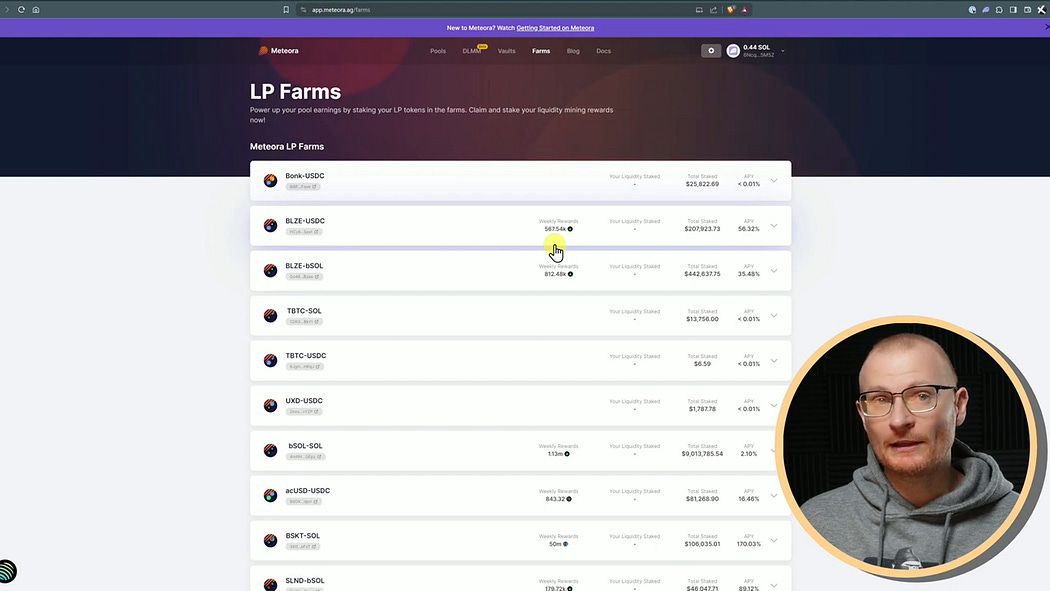

3. LP Farms: That’s where you can rake in extra tokens like the Blaze token from bSOL for participating in specific LP pairs, e.g. Blaze and USDC.

4. Dynamic Liquidity Market Maker (DLMM): Now, onto the star of the show. The DLMM is a slick toolbox for dynamic liquidity market making, and it’s a total game-changer.

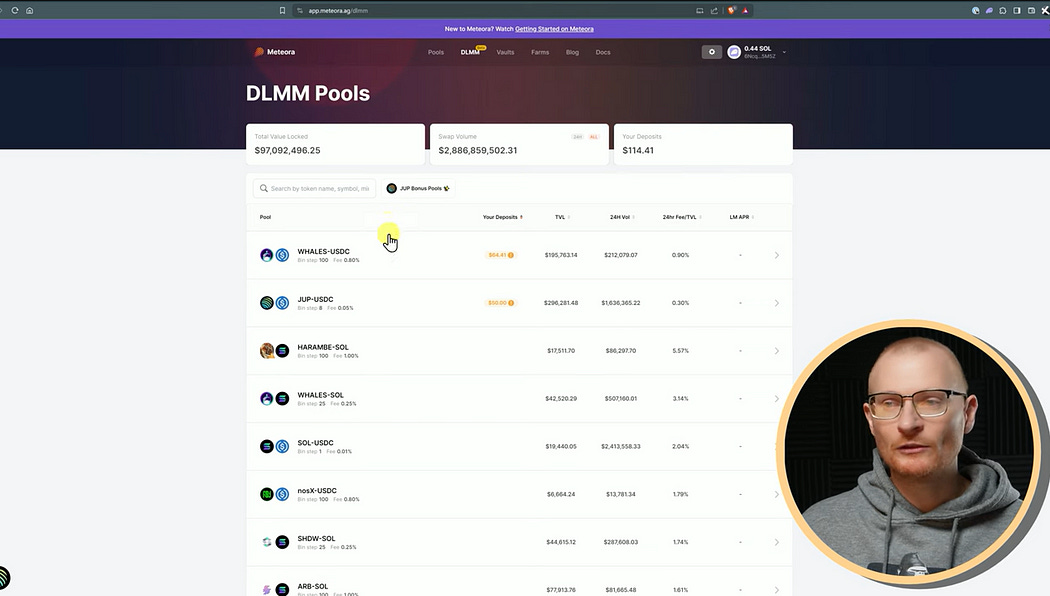

The DLMM dashboard throws a real-time glance at the Total Value Locked in its pools, 24-hour swap stats, and your current deposits if you’re already diving deep.

Craving for some data? You’ve got TVL insights, volumes, fee percentages, and LM APR (Liquidity Mining Annual Percentage Rate) details for each pool.

The LM APR is your hook for earning extra tokens by providing liquidity. Some pools have it, and some don’t.

How to Add Crypto to a DLMM Pool?

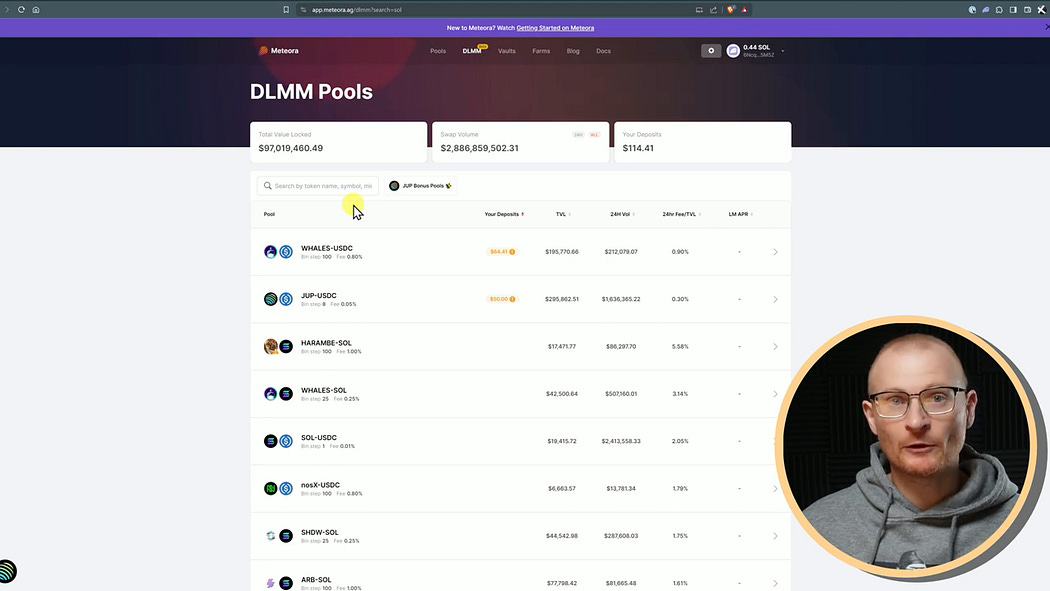

Here’s how to add your crypto to a liquidity pool. Fire up the app and type in what token you want, e.g. ‘SOL’.

Check out the available options, but we’re choosing SOL and USDC for this tutorial. Why? It’s got over a million bucks in the pool!

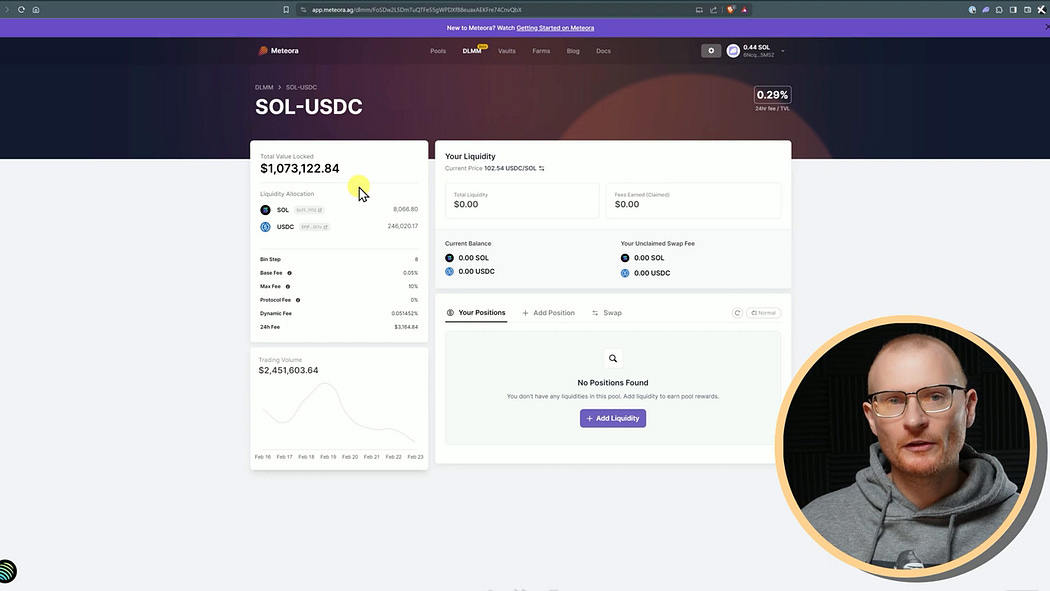

But in order to proceed, we need to understand the concept of a ‘Bin step’,

What is a Bin?

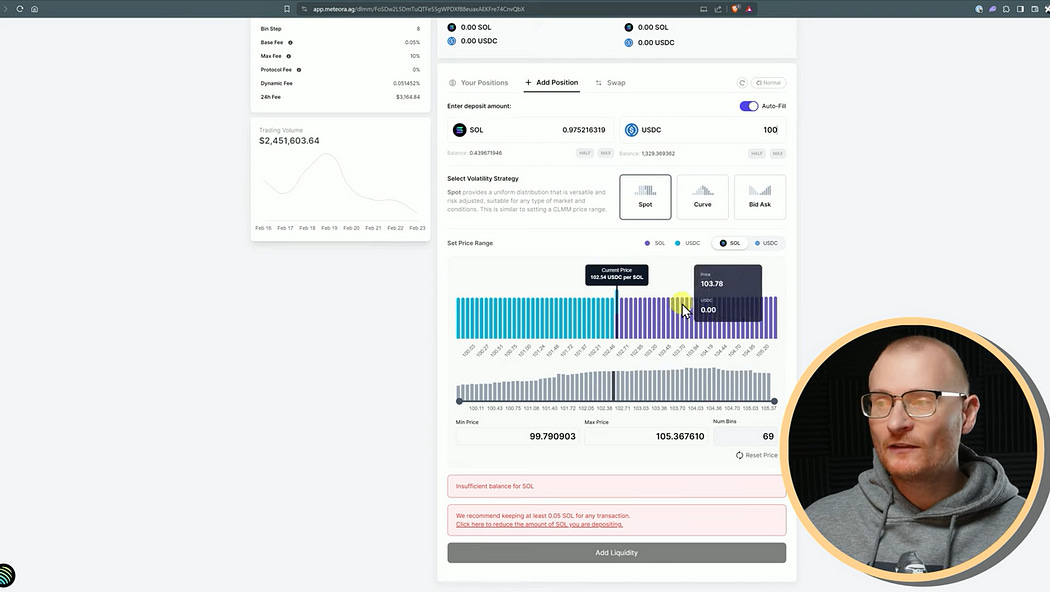

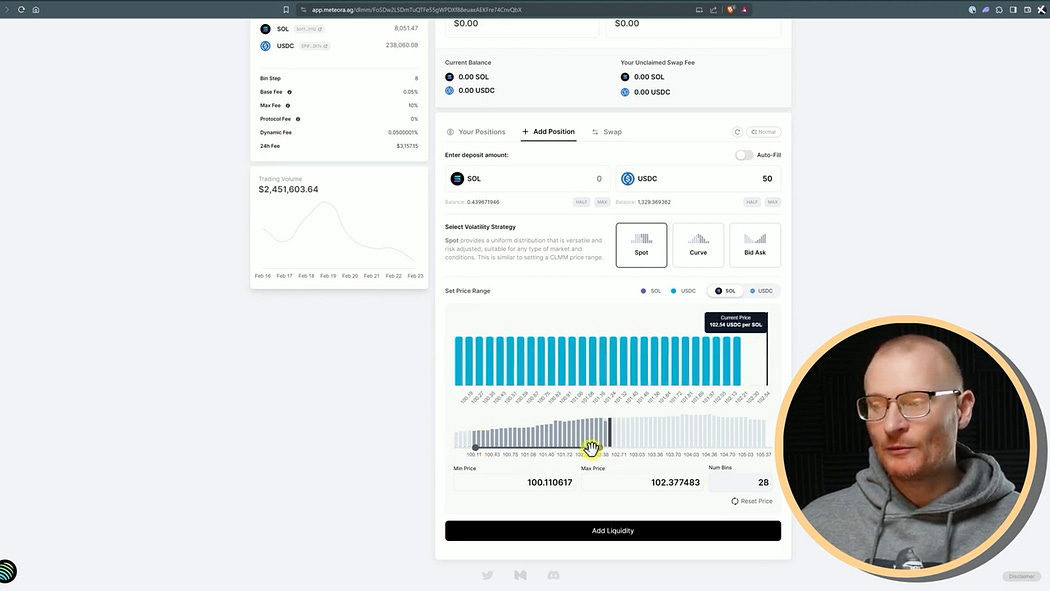

A bin is a place where you can put your liquidity, there are 69 bins available and you would be evenly distributing your USDC into each of these bins (when using the Spot strategy), simply put, a bin is the price range where the token will trade.

What is a Bin Step?

A bin step is the amount of basis points between one bin and the next. In this case, there are 69 bins, if you reduced the number of bins to 2 you would see that there’s 0.008% between the two prices, which is seen as the bin step is ‘8’.

It’s a good idea to use a small bin, e.g. 8, for things that are not very volatile and a larger bin, e.g. 100, for things that are more volatile.

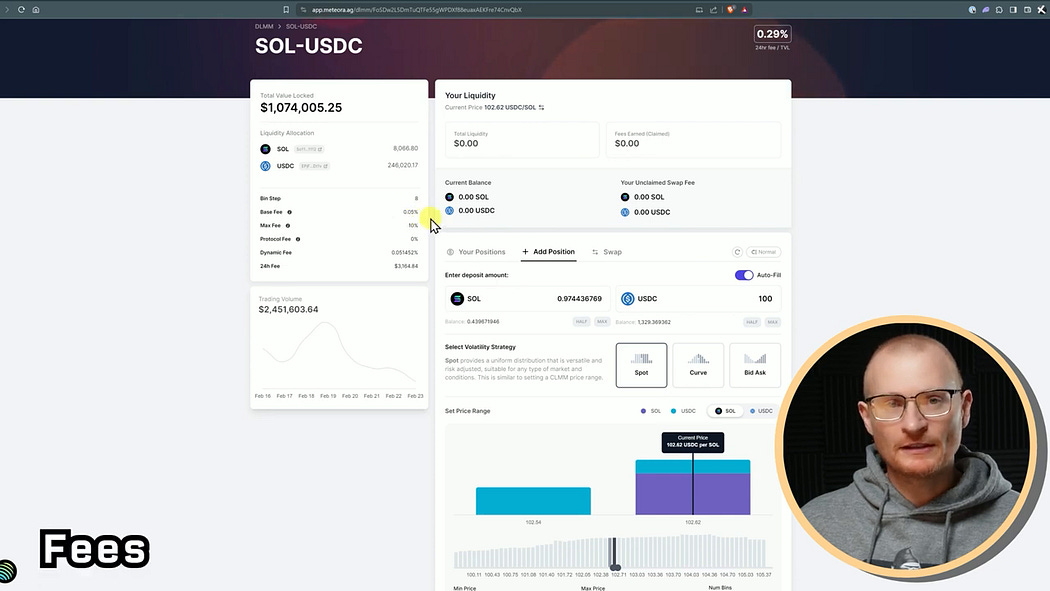

Understanding Meteora Fees

It’s important to note that your base fee can climb all the way up if there’s a lot of volatility and volume in a particular liquidity pool. At present, the protocol fee, which is the fee Meteora is taking, is actually 0%, and the dynamic fee, which is the overall fee, is just the same as the base fee, and it could climb up as well if there is a lot more volume and volatility.

24H fees are the fees that have been collected by the entire liquidity pool over the last 24 hours.

P.S. 69 bins are the maximum number of price ranges we can choose with one liquidity position. If you want access to more liquidity bins, you would need to open multiple positions and set them differently.

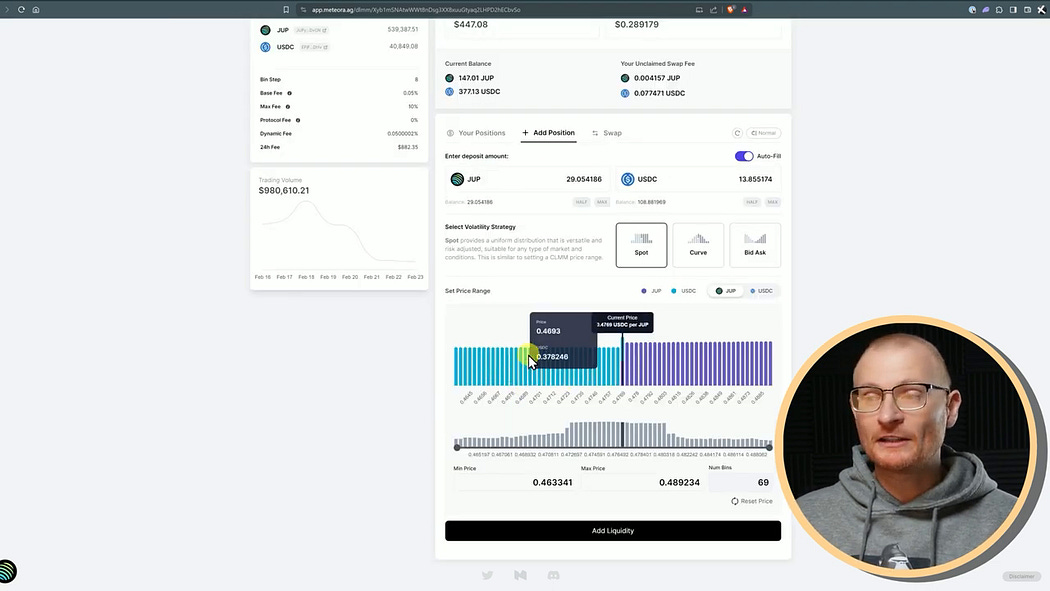

How to Add Liquidity to the DLMM Pool?

Now, we’re armed with knowledge and ready to continue to the next step of adding liquidity to the pool.

Go ahead to input how much USDC or SOL you want to provide and set your price range.

It is important to note that if you are not providing liquidity for SOL, then no SOL will be added to the liquidity pools, so it’s one-sided. Additionally, you can reduce the number of bins if you want a tighter range.

When you are satisfied with your price range and number of bins, you go and click ‘Add Liquidity’.

When the USDC leaves our wallet, a Solana fee is attached to it called ‘Rent’, and we can claim this back when we close the position.

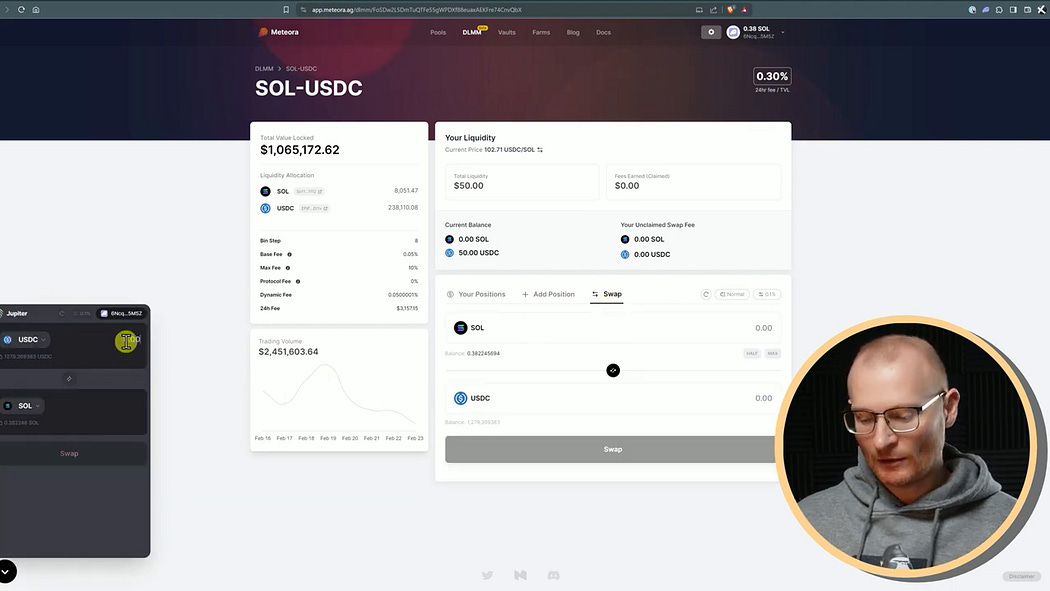

How to Perform Swaps?

When it comes to swapping, we can either swap on the Meteora DApp or on Jupiter Exchange by tapping the Jupiter Exchange logo at the bottom left of our screen because Meteora is integrated with Jupiter Exchange.

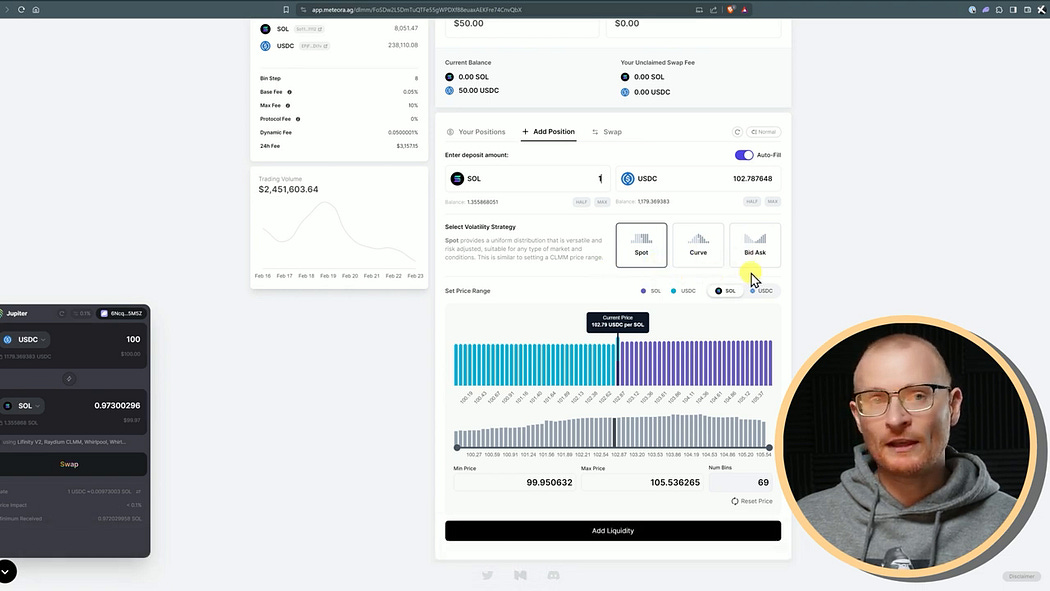

Choosing your Volatility Strategy

Meteora offers three volatility strategies; however, if you are familiar with their SDK, you can create and deploy your own volatility strategy.

Here are the three strategies:

1. Spot Strategy

2. Curve Strategy

3. Bid-Ask Strategy

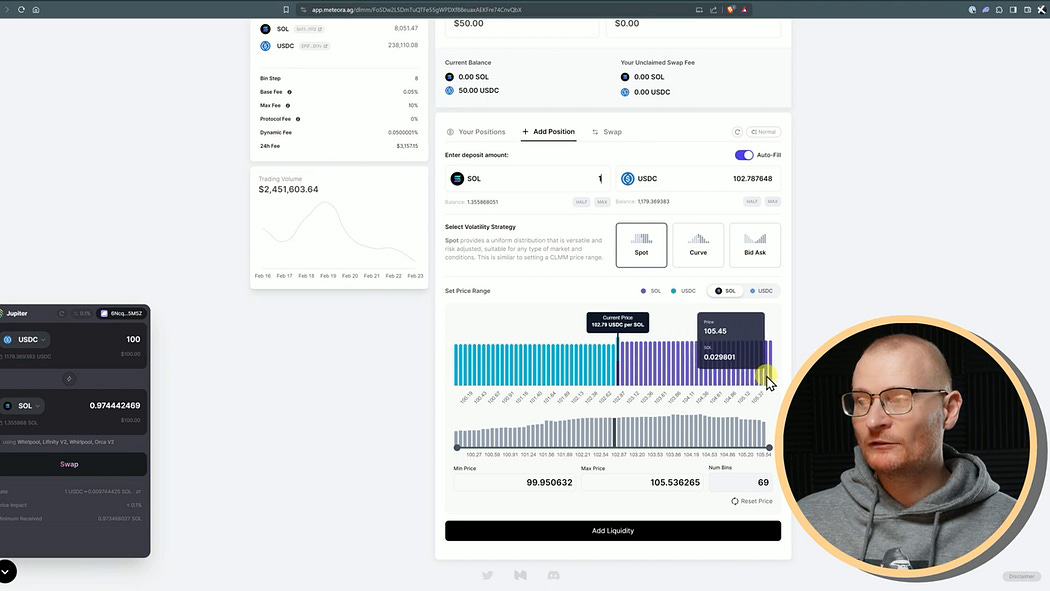

The Spot Strategy

In the Spot strategy, there is an equal amount of crypto going through every bin we’ve selected, which means if you are providing both USDC and SOL liquidity on both sides, your USDC will be equally distributed between half of the bins. SOL will be equally distributed between the other half; when you’re satisfied, add liquidity, confirm the transaction, and your position will be added.

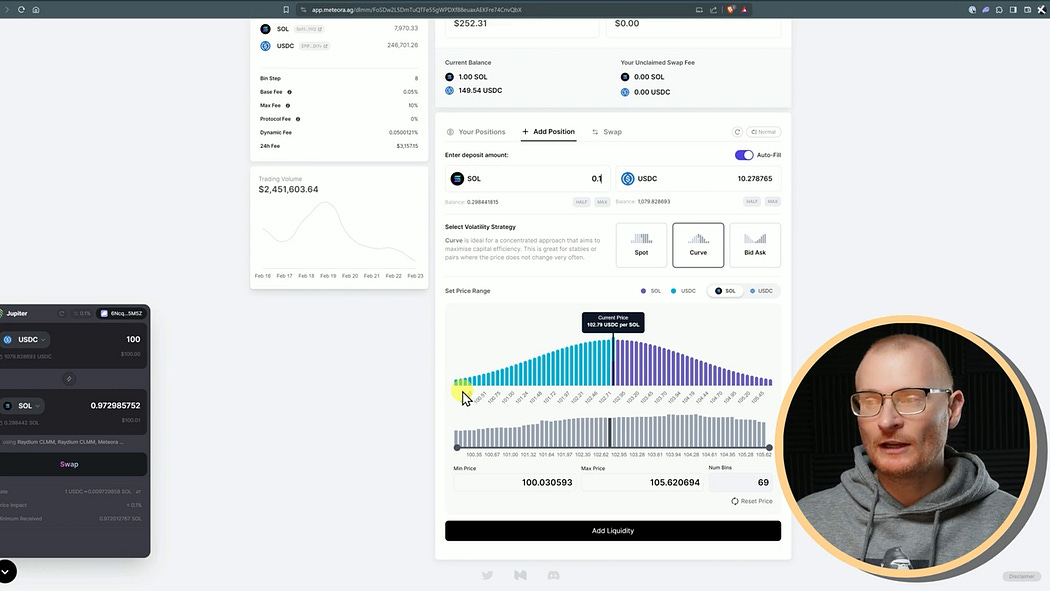

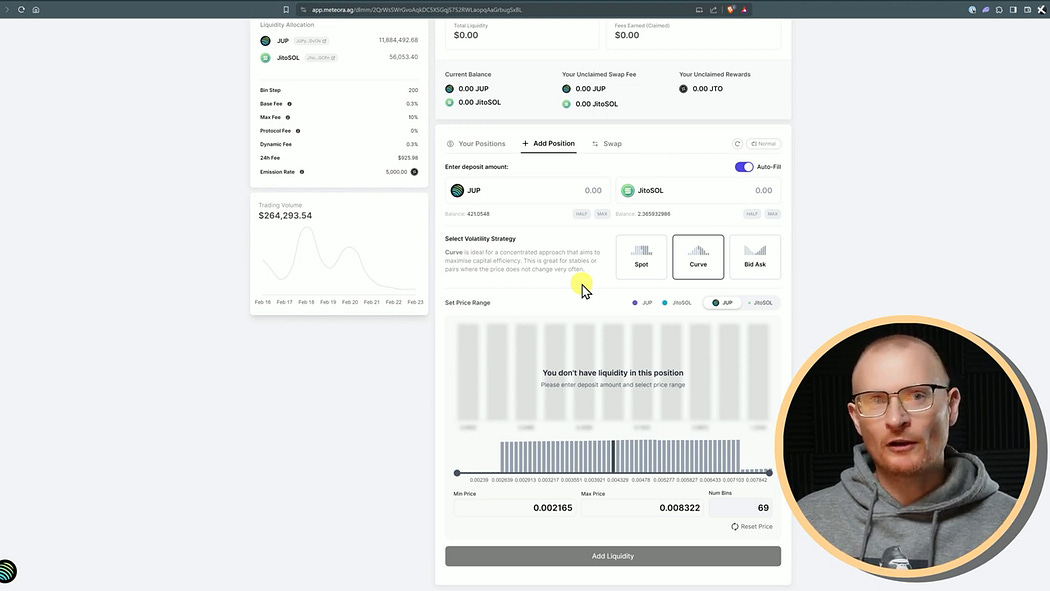

The Curve Strategy

In the curve strategy, most of the trading happens at the highest part of the curve,

On the opposite end of the curve, where our crypto is really low, no trading happens whether the price falls really low or goes really high.

You can also adjust the range to make it narrower if that’s what you prefer; when you’re satisfied, add liquidity, confirm the transaction, and your position will be added.

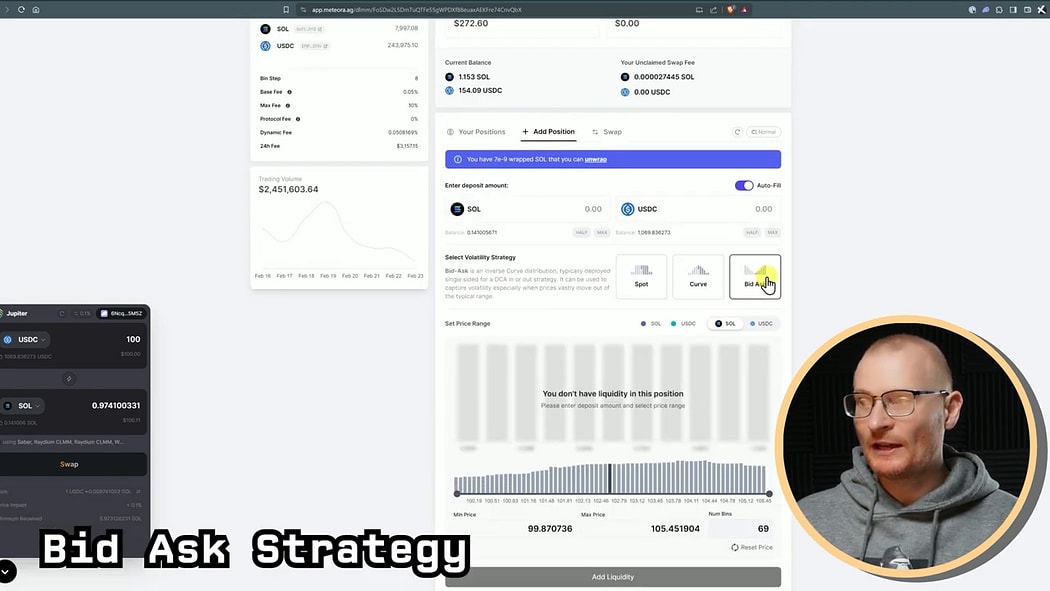

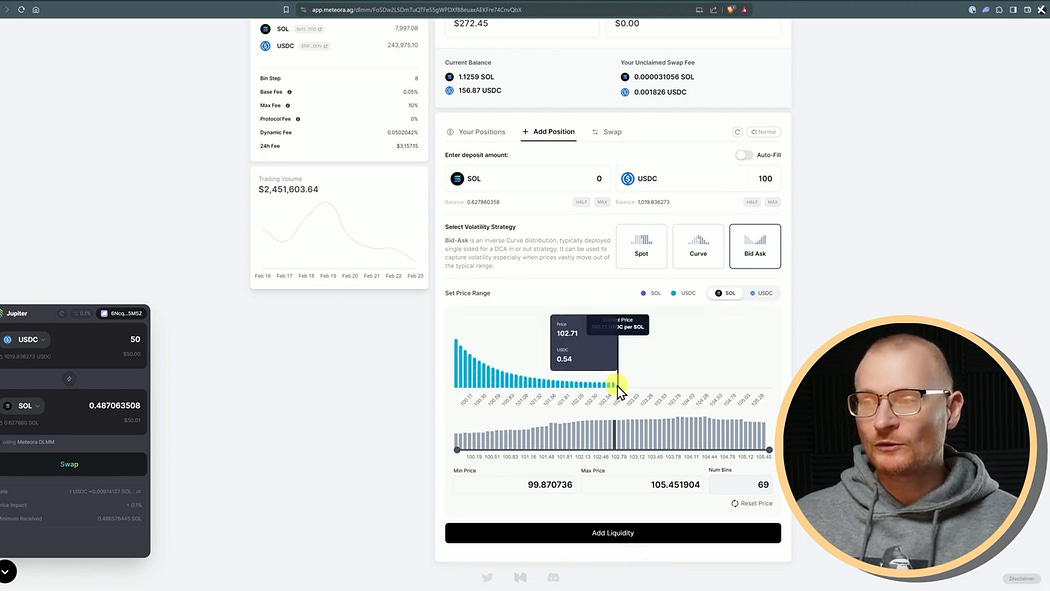

The Bid-Ask Strategy

You can use this strategy to Dollar Cost Average (DCA) out or into a position; it can also be used to capture volatility; you can add liquidity on a single side or both sides; for this tutorial, I’ll be doing a single side.

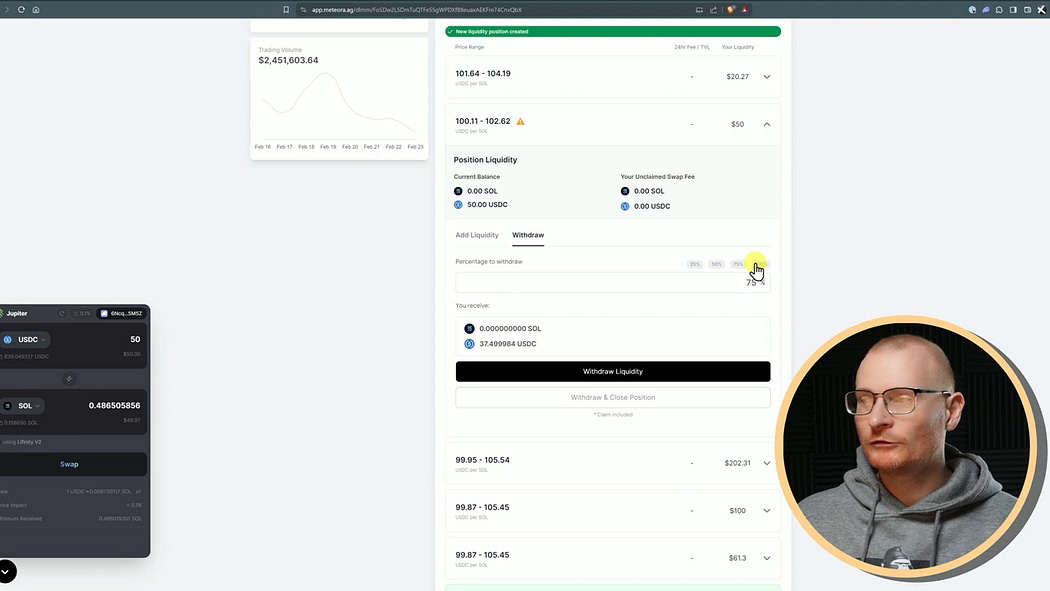

How to Change the Range and Close a Position?

You can change the range by withdrawing liquidity, and if you want to maintain your position, you can tap the ‘Withdraw liquidity’ button; however, if you want to close the position, you can tap the ‘Withdraw & close position’ button.

How to Use the Coffee Shop Strategy?

To use this strategy, we would have to deploy the ‘Curve volatility strategy’, which is a great strategy for stable tokens or pairs where the prices do not change too quickly. The curve strategy is also optimal if you’ll be providing liquidity for a short time.

You go into a coffee shop, open your laptop, and start earning some yield. By the time you are done drinking your coffee, you have paid for your coffee in yield and fees, and you close the position. Hence, it is called the coffee shop strategy.

Fun fact: this term was coined by Ben Chow.

P.S. When it comes to liquidity providing, ‘Impermanent loss’ is a concept you MUST familiarise yourself with.

Simply put, impermanent loss is the loss in value of your liquidity share if an asset price changes. It’s called impermanent because it can recover if prices revert. But withdrawing before the price reverts makes the loss permanent.

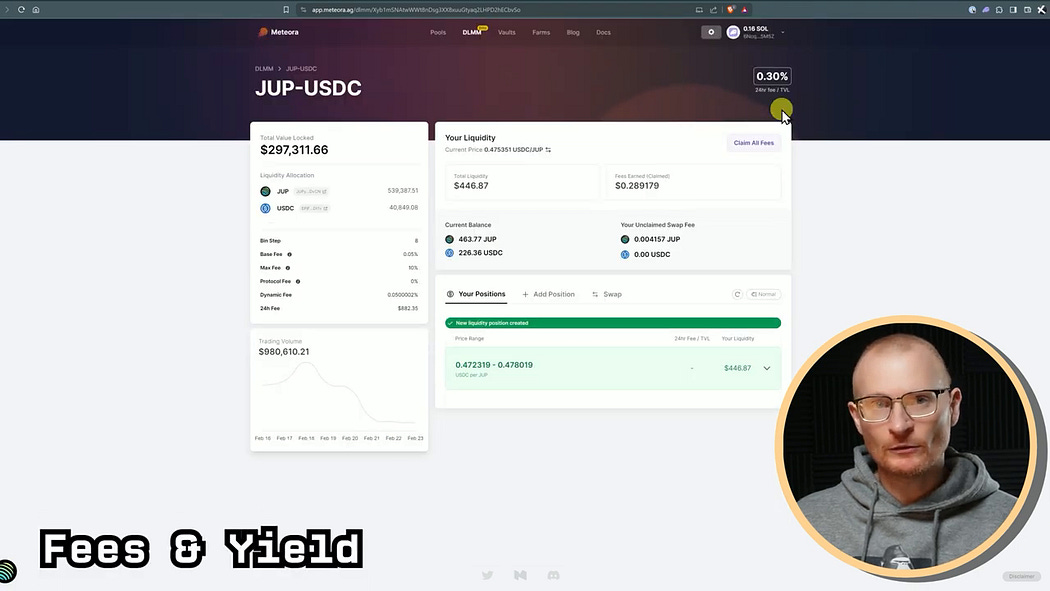

Understanding the Fees and the Yield

This is how to calculate the fee for your total pool:

Take the 24-hour fees in $ value, divide them by the TVL, and multiply them by 100. However, it’s written at the top for you, too, but this way, you can check it.

One thing to note is that if the price doesn’t go into any of the ranges you set, you will not be earning any yield, so you may need to adjust your range.

How to Use the Degen Approach?

When choosing a token, look for one generating large fees and then choose any strategy you prefer and use that to get some fees, keeping in mind that degen plays can have large price movements. For this approach, I used the spot strategy, but the curve strategy can work too.

Remember that the yield shown is dynamic and can change any time, so keep an eye on your position.

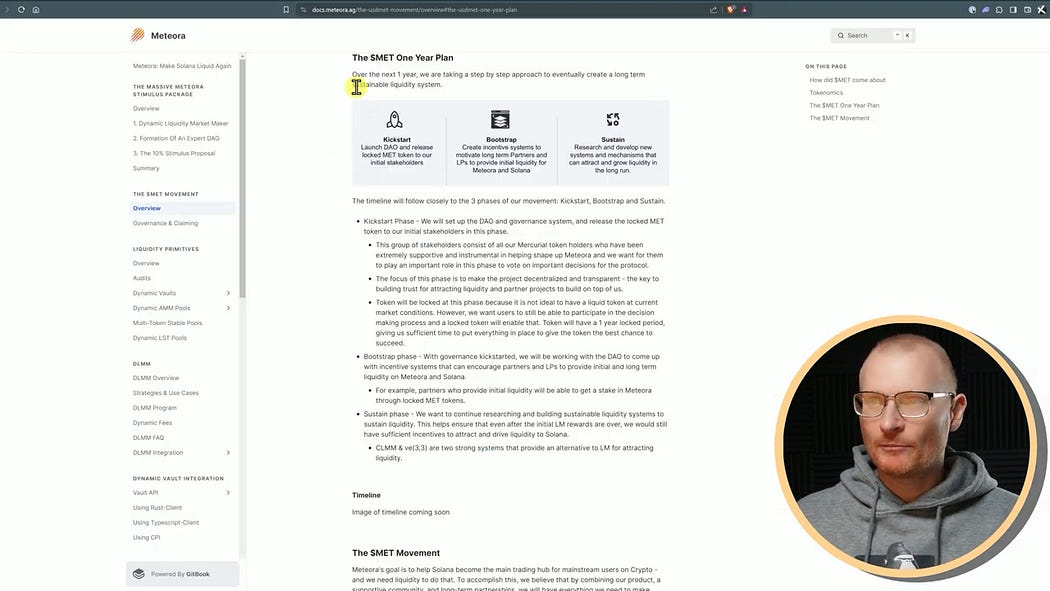

The Alpha on $MET Token

While we wait for more information on the $MET token, this is what we know: if you provide liquidity, you’ll be earning $MET, with some possible points system, no clear data, that will convert to the $MET token later.

I predict there will be $600 million worth of TVL by June 2024. This is just my personal opinion and not financial advice. You can stay updated with Meteora news by keeping an eye on their discord, and helping out in the community will give you some $MET points in the future.

If this is still all too confusing, or you’re just not ready to dip your toes into Meteora fully.

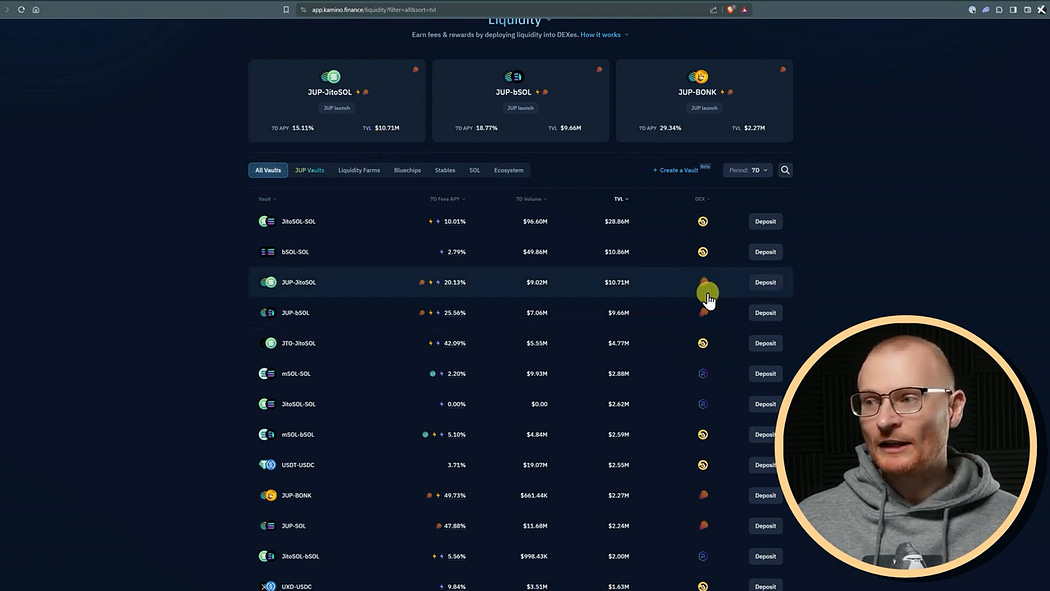

A beginner-friendly way to start providing liquidity is using Meteora via Kamino Finance.

Just go to Kamino Finance, tap on ‘Liquidity’, and you can tap on ‘Jup Vaults’, and you can see all the vaults relating to Meteora, and Meteora will manage the strategy for you.

Wrapping Up

Take a leap into DeFi’s new frontier with Meteora on Solana. With all the tricks and treats it offers, it’s hands-down your go-to platform in 2024. Don’t just stand there; dive in!

Disclaimer: This is a helpful blog. Follow me on my socials, but remember this is NOT FINANCIAL ADVICE. I am making this content as a community member because it is great to learn crypto, playing on Solana is fun, and it is easy to onboard friends into the space with a game like this.

My opinions are my own; research more if you wish, and if you decide to degen, that is your decision!

Follow me on X: https://x.com/SebMontgomery