Solana DeFi: Everything You Need to Know!

In August 2020, I was first introduced to Solana. The price was $2, and the speed was unparalleled.

Introduction

I remember watching a video with Alex Saunders and SBF. At the time, they were both heroes. Back then, he was hustling, and the bull market was not in full swing. DeFi was in its very early stages.

There was a video of SBF tapping keys on his keyboard, and every tap was a transaction on the blockchain. He sent 619 transactions in 15 seconds, with transactions taking under 2 seconds to confirm.

This was the moment I realised Solana was the future!

Fast Forward 42:10 to Watch the Speed of the Solana Blockchain:

In the early days of Solana, things were being built very quickly on the backend, but as a user, DeFi yielding opportunities were limited.

Serum

The first to launch in August 2020 was Serum.

Armani from Backpack was one of the developers behind Serum, but there was also a team of very competent engineers. Essentially, a CEX was created on the blockchain.

It was a bit complex for the majority, as crypto tends to be, and, as we later found out (when FTX collapsed in 2022), its token, $SRM, had terrible tokenomics that favoured FTX hugely.

Raydium

Next up, we had Raydium:

Raydium launched in Feb 2021, the staking of their token started in March.

This was amazing. This was an AMM pool with farms, very similar to Uniswap (ETH), Pancake Swap (Binance Chain), and Quickswap (Polygon)

The UI and UX was cleaner, and the speed and fees were insane. Raydium used their $RAY token in a staking mechanism that allowed an IDO mechanism for some mega token launches, such as ATLAS ($60 winning ticket token allocation was worth $10,000 2 days later).

Initially, Sollet Wallet was used, but after Phantom entered the game, things got a little crazy.

Orca

Orca next launched, and an airdrop went out to people who provided liquidity. Orca kept building and iterating and used the same AMM model as Raydium.

Mercurial Finance

Mercurial Finance was Meteora’s Predecessor. In fact, the team behind JUP, and Meteroa, came from Mercurial Finance (which was launched with Raydium. Mercurial created low-fee liquidity fees, similar to Curve on Ethereum.

From here, we had a crazy DeFi boom. With it came some juicy rewards and with it came some juicy rewards, enticing more and more users into the ecosystem.

Technical Features of Solana that Enable the DeFi Applications to Thrive

Solana’s unique technical features offer several advantages that specifically benefit DeFi applications, making it a popular choice for building and deploying them. It is also easy for the users to use the DApps as the transactions are very fast and cheap.

High Throughput and Low Latency:

Unlike most popular blockchains like Bitcoin and Ethereum, which struggle with scalability, Solana boasts high throughput, meaning it can process a large number of transactions per second (TPS). This allows DeFi applications built on Solana to handle frequent user interactions and complex functionalities without experiencing significant delays or congestion. Additionally, Solana’s low latency translates to faster transaction confirmation times, improving user experience and enabling real-time applications.Low Transaction Fees: Compared to other blockchains, Solana offers significantly lower transaction fees. This makes DeFi applications built on Solana more accessible to a broader user base, especially for those just getting into crypto who may not have the budget for high transaction fees associated with other platforms. The affordability also encourages users to participate in various DeFi activities like lending, borrowing, and trading without worrying about excessive fees eating into their returns.

Proof of History (PoH) Consensus Mechanism: While other blockchains rely on energy-intensive consensus mechanisms like Proof of Work (PoW), Solana utilizes Proof of History (PoH). This innovative approach timestamps transactions before they enter the network, allowing validators to quickly verify their order without needing to re-execute them. This significantly boosts transaction speed and reduces computational costs, making it more suitable for DeFi applications that require frequent and quick transactions.

Secure and Scalable Architecture: Solana utilizes a hybrid consensus mechanism combining Proof of History (PoH) with Byzantine Fault Tolerance (BFT), which ensures high security and scalability. This combination allows the network to handle a growing number of transactions without compromising security, making it a reliable platform for building robust and trustworthy DeFi applications.

Smart Contracts: Similar to other blockchain platforms, Solana supports smart contracts, self-executing contracts that automate agreements between parties. This allows developers to build various DeFi applications like decentralized exchanges (DEXs), lending protocols, and prediction markets, fostering innovation and expanding the range of financial services available within the DeFi ecosystem.

In summary, Solana’s combination of high throughput, low latency, low fees, secure and scalable architecture, and smart contract capabilities creates a fertile ground for DeFi applications to thrive. These features address the limitations of traditional blockchains and enable DeFi applications to offer fast, efficient, and cost-effective financial services, ultimately contributing to the growth and adoption of decentralized finance.

A Real-Time DeFi Application Example on Solana

I had 5.2 SOL in my Phantom wallet. I lent 5 SOL in a lending protocol like Kamino Finance, a lending protocol on Solana, and it’s earning a 6% APY. I borrowed 200 USDC against my SOL at 7% APY.

Then, I deposited 50 USDC into Drift Protocol’s USDC Insurance Earning Fund, and the USDC is earning a 37% APY.

I also deposited 50 USDC into Marginfi, and it’s earning a 17% APY.

Finally, I deposited the remaining 100 USDC into Parcl’s Liquidity Pool, which is earning 400 Points per day and will potentially qualify for Parcl’s airdrop in April.

My SOL is earning a 7% Annual Percentage Yield. Without selling my SOL, I borrowed USDC against it and deposited it into protocols that offer a higher Annual Percentage Yield. I’m also using a great DApp like Parcl and may receive an airdrop from it.

Isn’t this the future of finance? It certainly is for me! And it took me less than 5 minutes to complete all the deposits and transactions. The combined transaction fees cost me less than $ 0.008 USD.

With its blazing-fast speed and minimal fees, Solana helps you execute trades and manage your DeFi positions seamlessly and cost-effectively.

Airdrops on Solana

JUP announced their airdrop for their users. Around 955,000 wallets were eligible for the airdrop. The airdrop claim was announced on January 31st, 2024. This was a great test for the JUP team and even more for the Solana network. Many even feared the Solana network would break down due to the high demand the network would face when people started to claim their $JUP.

407,000 wallets claimed their airdrop on the First day.

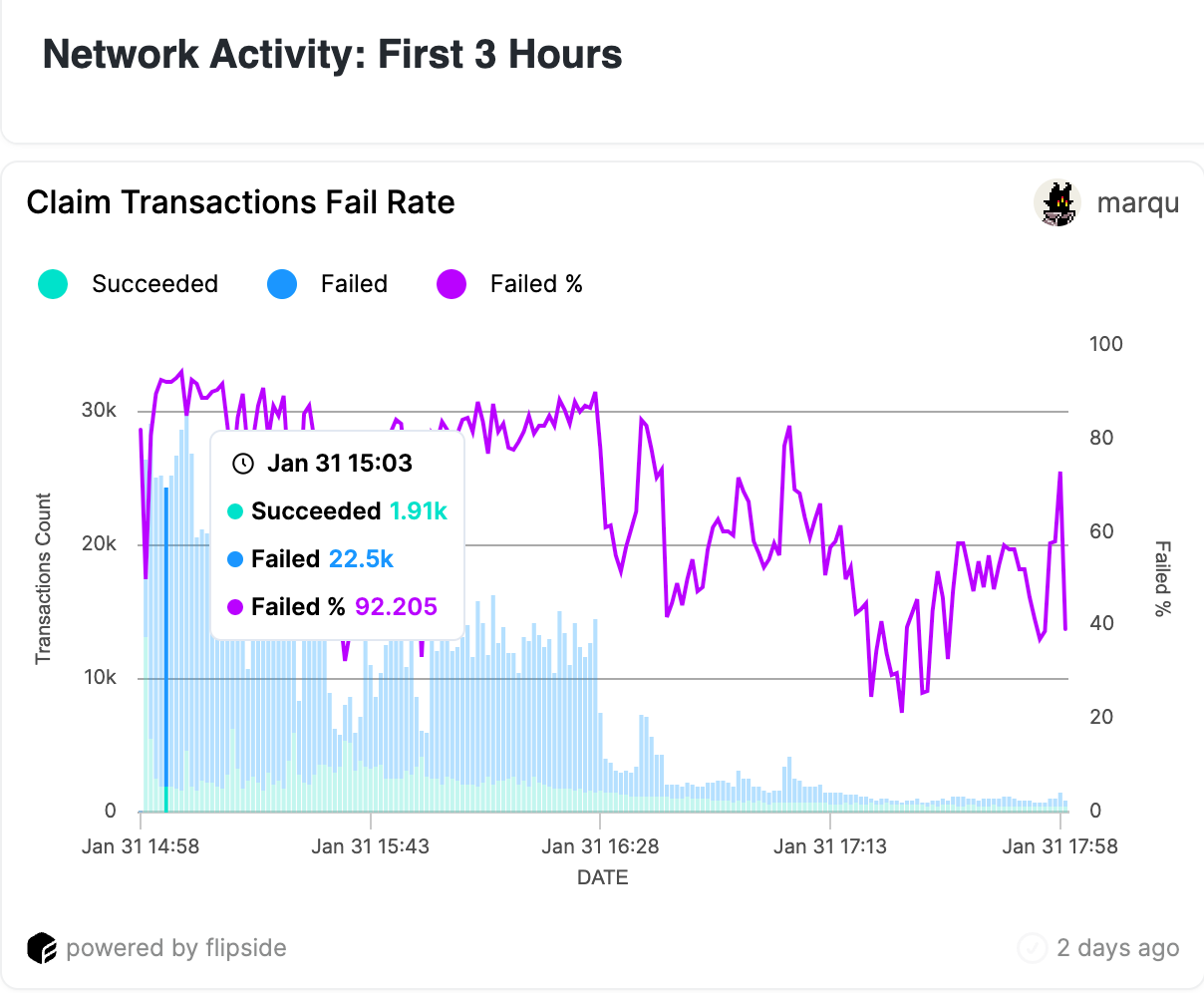

The below graph is the network activity during the claim for the first 3 hours.

The airdrop claim started on Jan 31st, at 14:58 hours, and the failed transaction percentage was the highest during the first 5 minutes of the claim. Let’s discuss the airdrop claim activity at 15:03 hours.

The failed transactions percentage at 15:03 was 92.205%, and even at peak traffic, the successful claim of transactions was 1,910 per minute. That is 31.83 transactions per second (TPS). That’s not a bad success rate during high network congestion. Ethereum, a blockchain known for its smart contract platform, has an average TPS of 15 to 30, and during peak network congestion, it can drop below 10 TPS.

It’s also important to take into account that JUP had Triton as their default RPC on their claim site. My transaction failed because I tried to claim my $JUP in the first few minutes with the default RPC setting. I switched the RPC to Helium, and I was able to successfully claim my $JUP in multiple wallets, all in the first few minutes of the airdrop claim.

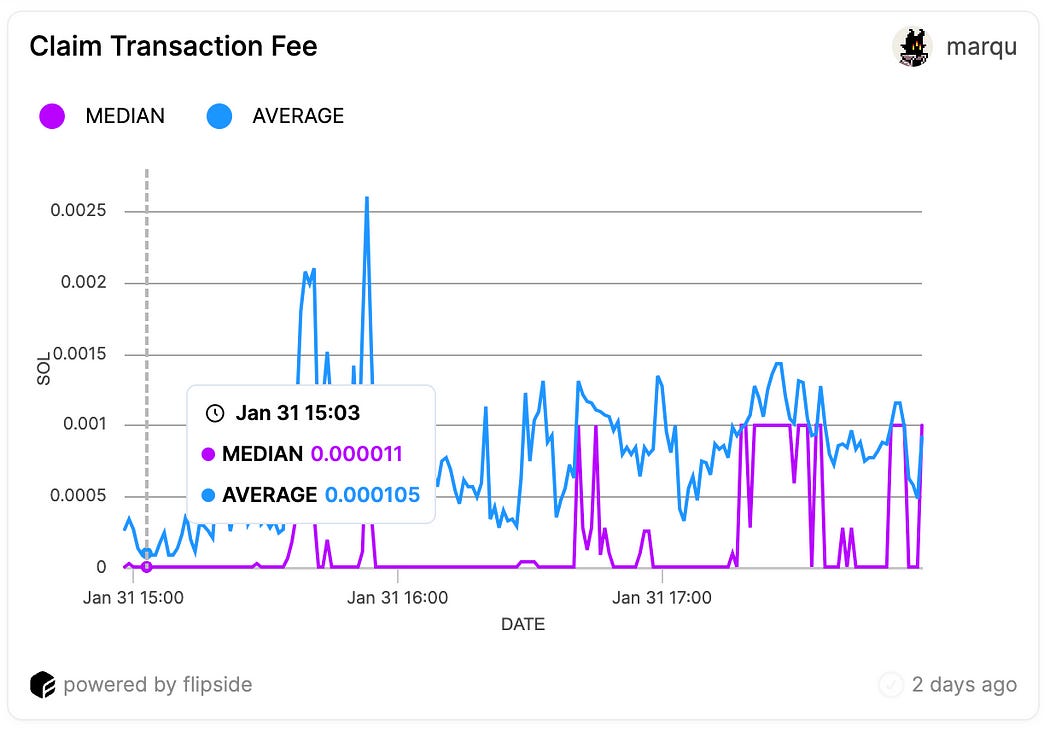

Now, let’s discuss the transaction fee during the airdrop claim at 15:03 hours. The average transaction speed during the highest network congestion was 0.000105 $SOL, USD 0.011.

During high network congestion periods, Ethereum has had a transaction fee of around USD 1,000. During the BAYC’s Land Mint, many users had to pay a gas fee of around USD 3,000 to mint 1 NFT.

DeFi Apps on Solana

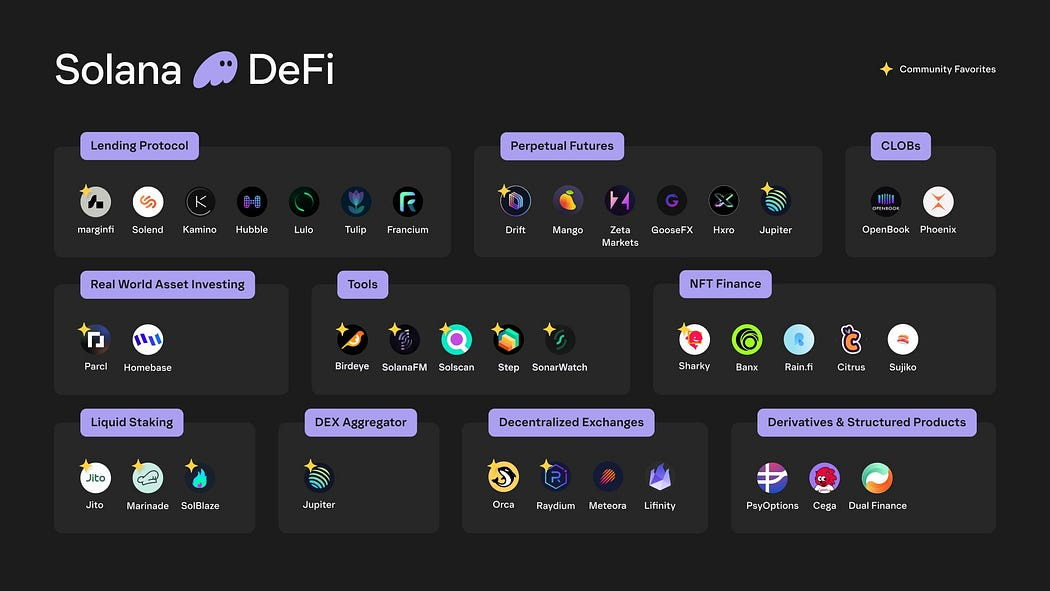

Solana boasts a wide range of DeFi apps. Throughout this post, we will cover:

1. Lending platforms

2. DEX (Decentralized Exchanges)

3. DEX Aggregator

4. Liquid Staking

5. Automated Market Makers

6. Yield farming opportunities

7. Real World Asset Investing

8. Portfolio Trackers

9. Blockchain Explorers

10. Trading Data Aggregators

11. CLOBs

12. Perpetual Futures

Lending Protocols

Lending platforms offer users the opportunity to earn interest on their crypto holdings by lending them out to borrowers. This can be an attractive option for individuals and institutions looking to generate passive income on their crypto assets.

Borrowers, in turn, can access funds without needing to sell their crypto holdings, which can be particularly useful for traders and investors who want to maintain their long-term positions.

The most popular lending protocols on Solana are Kamino Finance, Marginfi, and Solened Protocol.

Here’s a Video Guide on How to Borrow & Lend with Marginfi:

Also, an interesting DApp to keep in mind is Flexlend. You can get the most yield on your USDC and USDT by depositing into Flexlend. How it works is that Flexlend automatically deposits your stables into a protocol that offers the highest yield. If Kamino Finance is offering 12% on USDC and Marginfi is offering 16%, automatically, your USDC will deposited into Marginfi.

Here’s a Video Guide on How to Earn More Yield on Your Stables with Flexlend:

Decentralized Exchanges

Usually, the first step in a crypto beginner’s journey involves a centralized exchange (CEX) to convert their fiat currency to crypto. While CEXs can feel easy and intuitive, they’re not the safest for storing your funds since the company behind the service can lose or block your access.

Decentralized exchanges, or DEXs, are the solution to this problem. DEXs rely on smart contracts to facilitate peer-to-peer trades, so you can trade crypto while retaining full control of your assets without having to trust a third party.

The most popular DEX’s on Solana are Orca, Raydium, Meteora and Lifinity.

Decentralized Aggregator

A spot DEX aggregator in crypto refers to a platform or service that aggregates liquidity from multiple decentralized exchanges (DEXs) to offer users the best possible prices for their trades.

JUP routes the best prices across the various DEXs. You can see in the screenshot below that liquidity is routed from Saber, Meteora, GooseFX, and Invariant.

The most popular DEX Aggregator on Solana is Jupiter.

Here’s a Video Guide on How to Use Jupiter to Swap Tokens:

Liquid Staked SOL

Before delving into liquid staking, let’s first understand the limitations of native staking. When you stake your $SOL with a validator on Solana, and if you want instant liquidity, you would have to unstake your $SOL and wait for the current epoch (around 2.5 days) to end before you can withdraw your $SOL.

Popular LST (Liquid Staked SOL) tokens on Solana are JitoSOL, Marinade Finance, and SolBlaze.

By staking your $SOL with liquid staking protocols, you receive liquid-staked SOL tokens. For example, if you stake your $SOL with JitoSOL, you receive $JitoSOL. Now, your $SOL is staked, and on top of that, you have liquidity with $JitoSOL that can participate in DeFi activities. Liquid staking improves DeFi activities on Solana while decentralizing the network by staking your $SOL.

Advantages of Liquid Staking

1. LST (Liquid Staked SOL) gives you the liquidity to participate in DeFi activities.

2. You can swap your LST into USDC or your favourite meme coin $BONK if you think the price is going to go up.

3. LSTs can be used in liquidity pools to provide liquidity to DEXs or automated market makers (AMMs) and earn users trading fees in return.

4. LSTs can also be deposited as collaterals in lending platforms and earn a yield.

5. USDC or USDT can also be borrowed against LSTs from lending protocol.

Here’s a Video Guide on How to Stake and Receive JitoSOL:

Automated Market Makers

Automated market makers (AMMs) on Solana are decentralized exchange protocols that facilitate the trading of tokens without the need for traditional order books. They work based on algorithmically determined prices, allowing users to trade assets directly with smart contracts rather than through centralized intermediaries.

Some popular automated market makers on Solana are Raydium, and Orca.

Orca is a user-friendly decentralized exchange (DEX )and liquidity aggregator on Solana. It offers various features, including AMM pools, limit orders, and token swaps, with a focus on providing a seamless trading experience for users.

Raydium is a decentralized exchange (DEX) and automated market maker (AMM) built on the Solana blockchain. It offers liquidity pools and allows users to swap tokens with low fees and high speed.

Here’s a Video Guide on How to Use Orca for DeFi Farming:

Yield Farming Opportunities

Yield farming protocols on Solana are decentralized finance (DeFi) platforms that allow users to earn rewards, typically in the form of additional tokens, by providing liquidity to liquidity pools or participating in other activities such as lending, borrowing, or staking. These protocols leverage the high throughput and low transaction costs of the Solana blockchain to offer efficient and cost-effective yield farming opportunities.

Some popular yield farming protocols on Solana are Raydium, Orca, and Mango Markets.

CLOBs

Central Limit Order Books, AKA CLOBs, are decentralized exchanges (DEX) where traders can submit buy and sell orders for various assets. These orders are matched based on price and time priority. They operate similarly to traditional exchanges, where the order book is maintained centrally, and trades are executed by the exchange’s matching engine.

Some popular CLOBs on Solana are Pheonix and Open Book.

Let’s say the current price of $SOL is $110. You could place an order to buy $SOL at $80, and if the price of $SOL goes to $80, the order will be automatically executed just like in a Centralized Exchange, but with your custody.

Here’s a Video Guide on How to Place Orders on Pheonix Trade:

Perpetual Decentralized Exchange

Perpetual decentralized exchanges (DEXs) are decentralized exchange protocols that offer perpetual swap contracts, allowing traders to speculate on the price movements of assets without an expiration date. These contracts typically track the price of an underlying asset and use funding rates to ensure that the contract’s price closely matches the spot price of the asset.

Some popular Perpetual DEXs on Solana are Drift Protocol, Zeta Markets, and Jupiter Perps.

How Do Perpetuals Work?

Let’s say the price of $SOL is $100. If you think the price of $SOL is going to go up, you can “GO LONG” on $SOL and set a Leverage from 1.1x to a maximum of 100x. The lower the leverage, the safer. The higher the leverage, the riskier the trade is, but the higher the potential for returns.

Now, let’s say you have $100 USDC, and you want to “GO LONG” on $SOL at $100 with a 3x Leverage. It means you’re controlling a 3 $SOL Position for $100 USDC. When the price of $SOL is at $150, you can close the 3 $SOL Position for a profit of $150 USDC.

Profit = SOL Position Bought * (Closed price - Open Price).

Profit = 3 ($150 — $100) = 3 x $50 = $150 USDC.

One important thing to keep in mind while doing a perpetual trade is the Liquidation Price. In this case, the Liquidation Price would be $68.78, which means if the price of $SOL reaches $68.78, your position would be liquidated, and you would lose your $100 USDC.

Whereas if you had bought spot $SOL at $100 for $100 USDC, and if you sold at $150, you’d only get a Profit of $50 USDC.

Perpetuals are not easy to understand, but as you keep making a few trades, you will get the hang of it.

Here’s a Video Guide on How to do a Perpetual Trade on Drift Protocol:

Blockchain Explorers

Blockchain explorers are web-based tools or applications that allow users to browse and interact with data stored on a blockchain network. They provide a user-friendly interface to explore various aspects of the blockchain, including transaction history, account balances, smart contracts, and network statistics. Blockchain explorers play a crucial role in providing transparency, accountability, and accessibility to blockchain data for users, developers, and researchers.

Some popular Blockchain Explorer on Solana are SolanaFM, Solscan, and Solana Beach. However, the easiest to use is SolanaFM.

Role of Blockchain Explorers in DeFi:

Track transactions in real-time, allowing users to search by transaction hashes or addresses and view details like timestamps, amounts, and sender/receiver addresses.

Provide account information, including balances, transaction history, staking status, and metadata.

Enable interaction with smart contracts, including exploring code, inspecting variables, and executing functions.

To assess network health and performance, offer network statistics such as block height, hash rate, throughput, and block time.

Here’s a video guide on how to use a Solana Explorer:

Trading Data Aggregators

Trading data aggregators are platforms or services that collect, consolidate, and analyze data from various sources within the cryptocurrency market. They aggregate data from multiple exchanges, liquidity pools, decentralized finance (DeFi) protocols, and other sources to provide comprehensive insights into market trends, trading volumes, liquidity, prices, and other relevant metrics. These platforms play a crucial role in providing traders, investors, and analysts with accurate and up-to-date information to make informed trading decisions.

The most popular Trading Data aggregator on Solana is Birdeye.

Role of Birdeye in DeFi:

Birdeye also provides accurate information on the contract address of a token, unique holder counts of a token, real-time market buy and sell orders, whale activities, and all the important metrics to improve DeFi on Solana.

Portfolio Tracker

Portfolio trackers play essential roles in decentralized finance (DeFi) by providing users with tools to monitor, manage, and analyze their cryptocurrency holdings and investments across various DeFi protocols and platforms.

Here Are Some Key Roles of Portfolio Trackers in DeFi:

Aggregate data from various DeFi platforms, making it easy for users to view their entire portfolio in one place.

Provide real-time updates on cryptocurrency holdings, including prices, total portfolio value, and gains or losses.

Maintain a record of transaction history across different DeFi platforms, helping users track investment activity and assess strategies.

Offer tools for portfolio analysis, including performance charts, allocation breakdowns, and risk metrics.

Allow users to set price alerts and receive notifications for significant price movements.

Simplify tax reporting with tools for generating tax reports and calculating capital gains or losses.

Integrate with wallets and exchanges to automate data import, streamlining tracking and management processes.

Here’s a Video Guide on How to Use Step Finance’s Portfolio Tracker:

Real World Asset Investing (RWA)

Parcl plays a unique role in Solana's DeFi ecosystem by offering exposure to real-world assets within the traditional DeFi landscape.

It allows users to invest in real estate through city indexes and provides an avenue for diversifying DeFi portfolios beyond cryptocurrencies and DeFi protocols. This diversification can help hedge against potential risks associated with crypto market volatility.

Parcl offers leverage options of up to 6.6x, enabling users to amplify potential returns (and losses) on their real estate investments, catering to experienced traders seeking higher risk-reward profiles.

What Does Parcl Solve?

Buying and selling a land or a house in real life is not particularly easy. If you want to sell a house, you’d have to wait for the buyer as the market is illiquid.

Parcl solves this by providing a fractional ownership and secondary market for real estate assets represented by city indexes on the Solana blockchain.

Fractional ownership: Instead of requiring a large sum of money to buy an entire property, Parcl allows users to invest in smaller fractions of real estate assets through tokens. This makes real estate investment more accessible to a wider range of people.

Secondary market: Parcl creates a secondary market where users can easily buy and sell their real estate tokens. This increases liquidity compared to traditional real estate, where selling an entire property can be time-consuming and challenging.

Here’s a Video Guide on How to Trade Real Estate on Parcl:

Role of Airdrop & Points in DeFi

DApps announcing points & airdrop of a token has remarkably increased the TVL, indicating an increase in the number of users and volume.

Points System

Back on July 3, 2023, Marginfi introduced the points system. After the announcement, there was a drastic increase in the TVL.

You can see in the image below the TVL rose from USD 3.15m to USD 17.52m in just under 16 days.

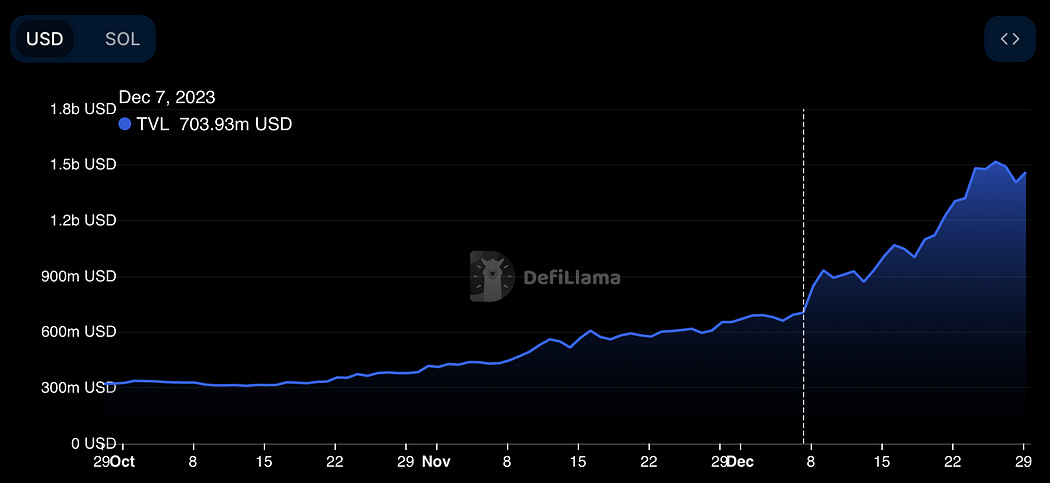

Airdrop

JitoSOL announced the airdrop of $JTO tokens for $JitoSOL stakers and the airdrop went live on Dec 27, 2023. The TVL on Solana rapidly went from $703.93m USD to $1.516b USD in the next 20 days.

A basic tier airdrop allocation received was around $20,000 if they had sold near the top in a few days after the TGE (token generation event). $JTO airdrop was trending all over Crypto Twitter, and it attracted liquidity from all other ecosystems, such as ETH, EVM L2s, and Cosmos.

The TVL over the last 4 months has been steadily increasing, indicating the interest in DeFi activities on-chain. Airdrops and points systems have played a huge role in the increase of TVL. The current TVL is USD 2.17b, with the likes of Parcl, Kamino Finance, and Drift Protocol all announcing an airdrop over the next few months.

How Airdrops Have Lead To User Adoption For DeFi?

I’ve been making video tutorials on the Solana ecosystem over the last 2 years. Most of the videos were made during the bear market, and they were used to get a minimum of 500 views to a maximum of 2k views. After the $JTO and $PYTH airdrop, I had several requests in the comments asking to make a video on the protocols on Solana with a potential airdrop.

And guess what? The video got 39,900 views and 2,000 subscribers, here’s the video:

These metrics show the role airdrops and points play. Announcing a points system or an airdrop by a protocol is a great marketing tool for DApps to onboard new users. The alpha is shared all over Crypto Twitter and YouTube by content creators and influencers, and soon, users start using the DApps.

Over the last 4 months, I have had requests from YouTube comments asking for tutorials on many DApps that have a points system or have announced an airdrop than a DApp that does not have a points system.

But what happens after the DApp airdrops the token to the users? How does the DApp retain its users?

Challenges DeFi on Solana Faces

While Solana’s high throughput and low transaction costs have laid a powerful foundation for DeFi, navigating the path to widespread adoption requires addressing several key challenges.

Post-Airdrop Retention:

Post-Airdrop Retention: Attracting users with airdrops is a good initial step, but retaining them is crucial. After the airdrop, people may leave, so we need to find ways to increase stickiness and make it valuable to hold the token. Additionally, activating users through educational resources and reward programs can encourage exploration beyond initial interactions.

Creating strong DAOs that foster a sense of community ownership and participation can increase long-term engagement.

Moreover, activating users through educational resources and reward programs can encourage exploration beyond initial interactions.

Liquidity via Bridging:

Liquidity needs to come from other chains. Attracting liquidity from other chains requires robust and secure bridges. Building trust in these bridges through transparency and thorough security audits is essential. Additionally, keeping the bridging fees minimal is important. Furthermore, providing comprehensive educational materials that simplify the process of moving assets to Solana will encourage wider participation.

Security and Smart Contract Audits:

Smart contracts, the backbone of DeFi applications (DApps), are susceptible to vulnerabilities and exploits. These vulnerabilities can lead to significant financial losses for users if not addressed. Open-source code allows the wider security community to scrutinize the code for vulnerabilities. This larger pool of eyes significantly increases the chances of identifying and addressing potential issues, leading to a more secure environment for users.

Here’s a Video Guide on Understanding the Risks in DeFi:

Insurance:

Insurance programs provide a financial safety net for users in case of losses due to smart contract exploits, hacks, or unforeseen bugs. This protects users from potentially devastating financial losses, encouraging greater confidence and wider participation in DeFi.

The availability of insurance can incentivize developers to prioritize security measures and best practices during development. Knowing their users are financially protected can encourage them to invest in thorough audits and implement robust security protocols.

This can lead to increased user adoption and attract more capital into the DeFi ecosystem.

Product Market Fit:

In the highly competitive DeFi landscape, a clear product-market fit helps differentiate Solana-based DApps by addressing specific user needs not met by existing solutions. This attracts new users and encourages wider adoption.

A great example of this is Whales Market. The market needed a DApp where users could sell their points earned from other DApps, their pre-allocated airdrop tokens, and hyped NFT whitelists. Whales Market built a great DApp that solves the needs of the market, and now they have a growing user base.

Gasless Swapping:

Instant, gasless token swapping from other ecosystems like Ethereum (using Vending Machines) and Cosmos would be helpful.

For example, allowing users to easily move USDC from Ethereum to Solana using Avici DApp and automatically receive the necessary SOL for transaction fees, while providing a step-by-step guide specifically for users coming from other chains, would significantly improve the DeFi experience on Solana.

DeFi in a Game:

Future prospects include integrating DeFi concepts into games, similar to what DeFi Land does. Gamifying DeFi has the potential to attract a wider audience and introduce them to DeFi in a fun and accessible way.

Disclaimer: This is a helpful blog. Follow me on my socials, but remember this is NOT FINANCIAL ADVICE. I am making this content as a community member because it is great to learn crypto, playing on Solana is fun, and it is easy to onboard friends into the space with a game like this.

My opinions are my own; research more if you wish, and if you decide to degen, that is your decision!

Follow me on X: https://x.com/SebMontgomery