NFTs: The Role of Alpha Callers

The value of accurate and timely information can't be overstated in the vast and dynamic ocean of the NFT marketplace.

Among the myriad voices in this digital expanse, alpha callers stand out as both beacons of guidance and potential sirens leading to rough waters. But first, let's set the scene on the importance of tuning in to the right sources and understanding the nuances that come with these digital treasure maps.

The Dual Edge of Alpha Insight and Where You Can Find Them

Alpha callers – those individuals or entities who share their take on worthwhile NFT investments – can wield significant influence. Some have proven track records, guiding followers to lucrative holds and flips, while others might as well be peddling snake oil. It's essential to parse through the noise and unearth the gems in this landscape teeming with prospectors and false prophets alike.

Twitter Spaces: The Unofficial NFT Conference Halls

One of the best arenas for alpha hunting happens to be Twitter Spaces. These virtual gatherings are akin to roundtables where the latest NFT insights are dissected. But here's the catch – diving into spaces requires discernment and a touch of skepticism. The trick is to not just absorb but to filter and jot down key takeaways actively. After all, anyone can host a space, and as an example, a seemingly promising show like "Everything Crypto, Volume 82" might lead to a vibrant discussion or a ghost ship of lost potential.

Timeline Treasures and Traps

Scrolling through the timelines of influencers can be another goldmine – or a pitfall. Take Thomas DAO, self-proclaimed "collab manager" for the once-hyped but now-defunct Wesleep project. His timeline has become a graveyard of abandoned promises, exemplifying the risk of putting faith in the hands of unknown entities. A retweet from April might be the only tombstone left in memory of a vanishing act that left many high and dry.

The Crucible of Credibility

To evade such disasters, it's essential to curate a list of voices worth your ear. And yes, it may take time and a few missteps, but as you weave through the maze, a pattern of credibility will emerge. The time may soon come when premium insights will bear a price tag – but that's a tale for a future chapter.

A Sneaky Peek into Linked's Alpha Calls

Shifting gears, let's consider LinkedIn. Here, alpha calls converge in a quieter corner of the internet, offering a mix of token and NFT insights. A simple search for "alpha calls" may yield a list as varied as the creatures in the sea – some benign, others waiting to gulp down your investment without a second thought.

Whale of a Thread: The Big Fish Signals

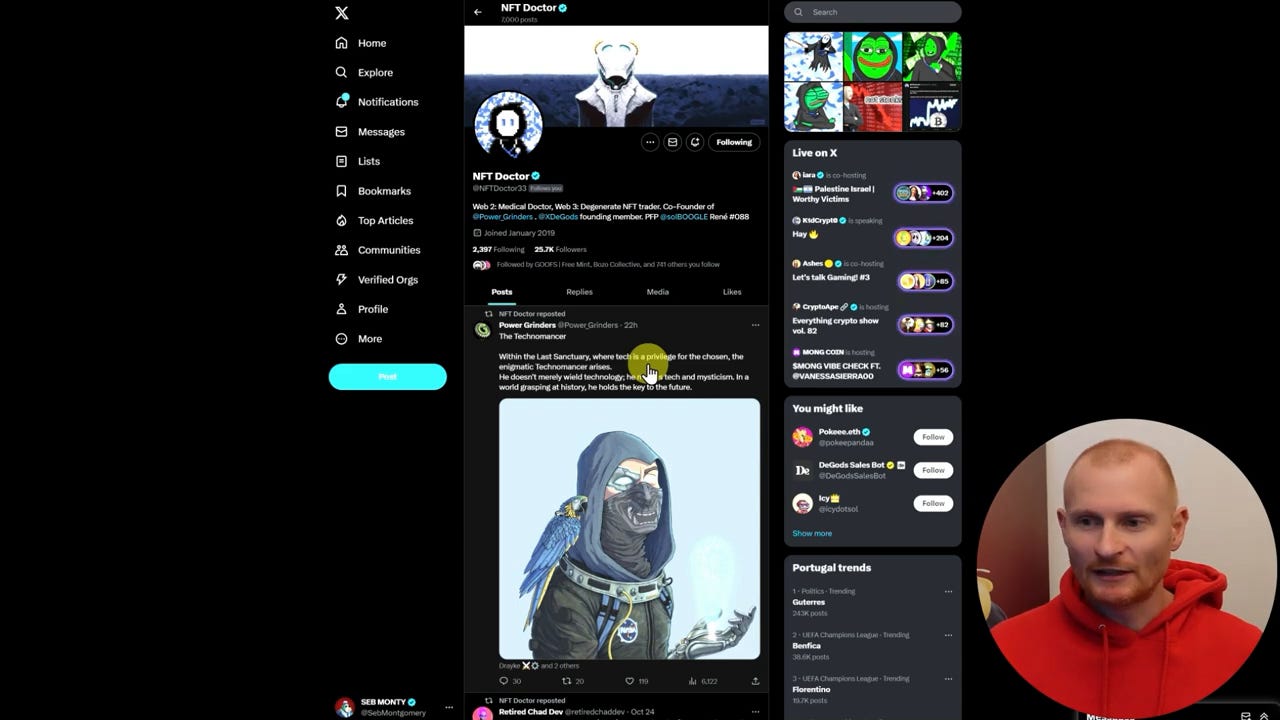

When the behemoths of the NFT world – the whales – speak, it often pays to listen. Their threads can become the breadcrumbs that lead to a feast or famine. If NFT Doctor makes a move, for example, that's often a signal worth noting. An endorsement might translate to immediate value appreciation, though the window of opportunity often resembles a fleeting gust.

Analyzing the Anatomy of an Alpha Call: The Case of Cranomis

Let's dissect an alpha call to understand the art and science behind it. Consider "Cranimus," an NFT project mentioned by an esteemed alpha hunter. At one point, it surged from near invisibility to a respectable 0.35 SOL in perceived value. But the ephemeral nature of such spikes is best illustrated when zooming out – today, it's worth less than its minting price.

The 'Sweep and Tip' Maneuver

The mechanics are simple yet sophisticated. Imagine a coordinated "sweep" of the floor – the lowest priced NFTs – by undisclosed wallets. A mere few hundred dollars in SOL can propel the floor price sharply. Once the initial sweep raises the perceived market value, the alpha call is dispatched, summoning a wave of buying pressure, which the initiators ride to a profitable shore.

The Great SOL Depth Dive

Let's join hands and dive deeper into the concept of market depth using Solana's (SOL) liquidity as an example. If depth is king, then exchanges like Binance hold the crown, boasting the ability to absorb a million-dollar SOL sale without disturbing the price more than a minute wave. In contrast, the liquidity pool for smaller coins, or indeed most NFTs, might be as shallow as a puddle – a sizeable investment can send ripples through the entire market.

The Art of Navigating Alpha Calls

Navigating the world of alpha callers in NFTs is like sailing through treacherous but rewarding waters. Here's how to steer clear of dangers and find guidance:

Avoid Low Liquidity Traps: Be cautious of alpha callers who entice you with low project mint costs, as these often lead to financial losses.

Beginner-Friendly Platforms: Newcomers should start at places like Linked, which is free and populated with experienced navigators.

Selective Listening in Twitter Spaces: Engage in these bustling forums, but choose your sources wisely to avoid misinformation.

Watch the Market Depth: Keep an eye on liquidity, a critical yet elusive factor in the NFT market.

These points offer not a treasure map but a compass for your journey in NFTs. Stay curious and navigate wisely for a prosperous voyage. See you on the next exploration.

Until next time, happy trading!

Disclaimer: This is a helpful blog. Follow me on my socials, but remember this is NOT FINANCIAL ADVICE. I am making this content as a community member because it is great to learn crypto, playing on Solana is fun, and it is easy to onboard friends into the space with a game like this.

My opinions are my own. You can research more if you wish, and if you decide to degen, that is your decision!

Follow me on X: https://x.com/SebMontgomery