Marinade SOL: mSOL — The DeFi Staking Token with Yield!

In the bustling world of cryptocurrencies and decentralization, there’s always an innovative way to enhance and manage your assets intelligently.

Marinade Finance is one of the most captivating applications in the Solana ecosystem. It has caught my eye, and I reckon it will intrigue you, too. Today, we will explore how this DeFi platform operates, specifically focusing on its star player, mSOL, a staking token that could amplify your Solana holding game.

The Essence of Marinade Finance and mSOL

Marinade Finance is a decentralized application (DApp) for staking, earning, and optimizing your Solana (SOL) cryptocurrencies. If you’re invested in the Solana network, Marinade Finance is a tool you want to familiarize yourself with for future strategies and, of course, to potentially increase your SOL holdings.

Getting Started with Staking on Marinade Finance

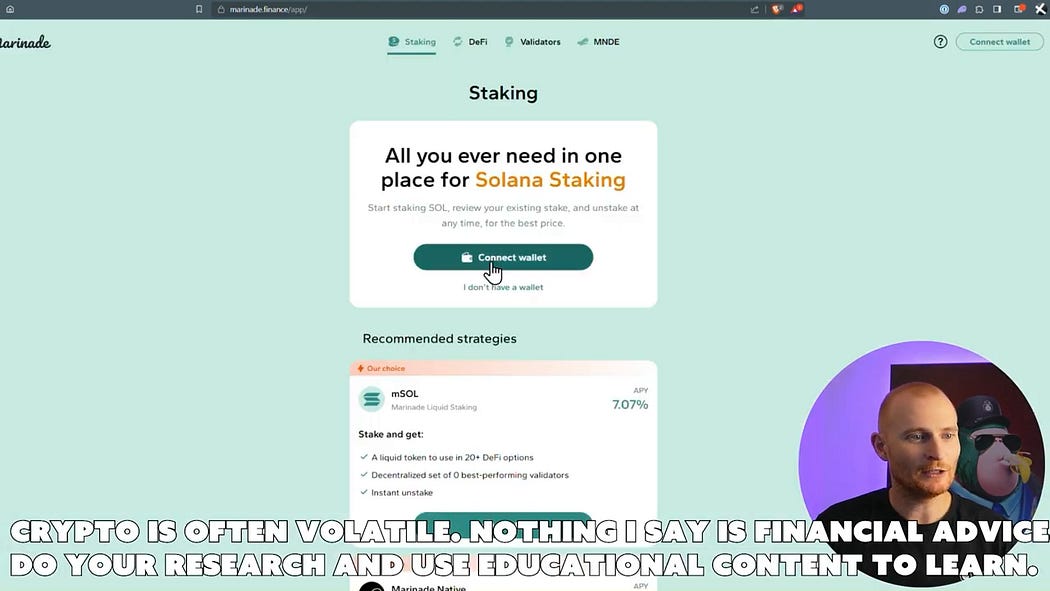

To start things off, you’ll want to connect your wallet to the platform. This process is straightforward and secure. Ensure to peruse their Terms of Use and Privacy Policy and verify that you’re not in a restricted jurisdiction. For this, you’ll need a compatible wallet such as Phantom.

When connecting your wallet, you’ll notice that I’m hooking up my DeFi address rather than my staking address. Why? The reason is that mSOL derived from staked SOL will be used in future DeFi strategies, So let’s embark on this journey:

Visit Marinade Finance.

Click on ‘Connect Wallet’ and sign in with your Phantom wallet (or another wallet of your choice).

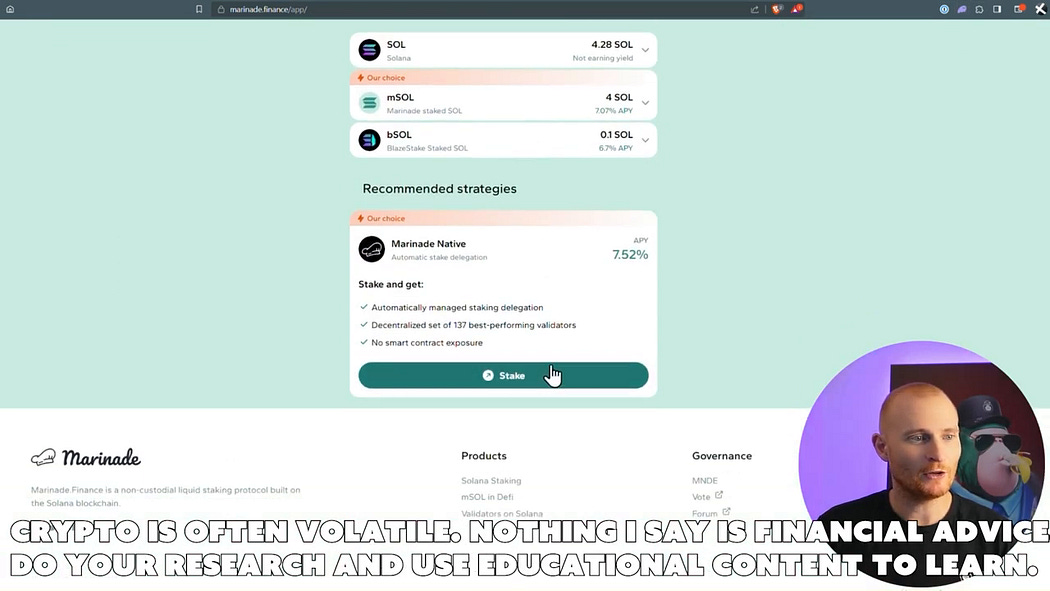

Once connected, you’ll see your active positions in SOL and bSOL (the bonded version of SOL).

Choosing Your Staking Strategy

Marinade Finance simplifies the staking process by recommending strategies:

1. mSOL Liquid Staking: This strategy yields mSOL with a 7% return.

2. Marinade Native: This strategy offers no smart contract exposure and offers a slightly higher return of 7.52%.

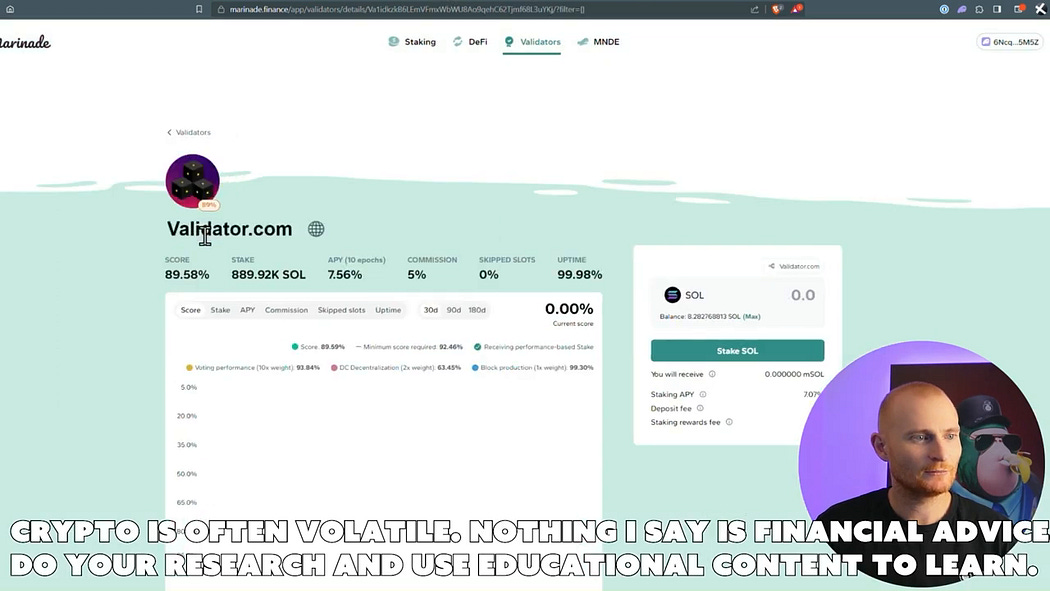

This strategic distribution of Solana amongst the top validators is what makes the platform exceptional. As the general manager of validator.com, I’m partial to advising you to stake with us, but Marinade Finance gives you options to choose from. They claim that staking 1 SOL with Marinade is comparable to staking 2.4 SOL directly with validators.

The Liquid Staking Advantage

When you stake SOL on Marinade, you receive mSOL in return — essentially a liquid token representing your staked SOL plus accruing rewards. The exchange rate favours mSOL because it’s often worth more than SOL alone due to the accumulation of staking rewards over time.

But wait, there's more to the staking reward fee!

When you stake, Marinade Finance takes a modest 6% cut from your earned rewards, still leaving you with an impressive 94%

Even after Marinade Finance's nominal fee, you still reap a solid net APY—which, in my opinion, often trends higher than advertised, despite what calculators might suggest.

Redistributing Your Stake

Want to diversify your stakes? Here's how you can spread your SOL across multiple validators:

Select 'Marinade Native' staking to distribute your SOL among many validators.

Stake with specific validators of your preference, like validator.com.

Unstaking and Redelegating

When the time comes to adjust your investments, Marinade Finance makes it a breeze. You can unstake or redelegate your SOL as you see fit, either instantly (with a small SOL fee) or after a designated cool-down period—conveniently managed in your Phantom Wallet or the Marinade app.

Transparent Risks and Trust in Marinade

Here's what you should know, while I trust Marinade Finance and mSOL's solidity, the unpredictable nature of cryptocurrencies means there's a slim chance mSOL could dip below SOL's value. Historical instances, such as the turmoil surrounding FTX in the past, may impact the SOL ecosystem, but these are exceptions, not the norm.

Trust in a platform comes with experience and consistent performance. Marinade Finance, with multiple high-quality audits and a clean track record, instils confidence in its users.

Moving Forward

With a thorough comprehension of Marinade Finance in our toolkit, the next step is to explore jitoSOL in our upcoming coverage. The exciting world of DeFi staking token yield is vast. As we continue to peel back the layers, you'll find that tools like Marinade are invaluable in maximizing your digital assets.

In Conclusion

Marinade Finance and mSOL offer a bridge to a more efficient and profitable way to manage your SOL. They blend the benefits of staking with the liquidity we crave in the fast-paced DeFi space.

Stay tuned, stay curious, and let's catch the wave of DeFi innovation together—until next time!

Disclaimer: This is a helpful blog. Follow me on my socials, but remember this is NOT FINANCIAL ADVICE. I am making this content as a community member because it is great to learn crypto, playing on Solana is fun, and it is easy to onboard friends into the space with a game like this.

My opinions are my own; research more if you wish, and if you decide to degen, that is your decision!

Follow me on X: https://x.com/SebMontgomery